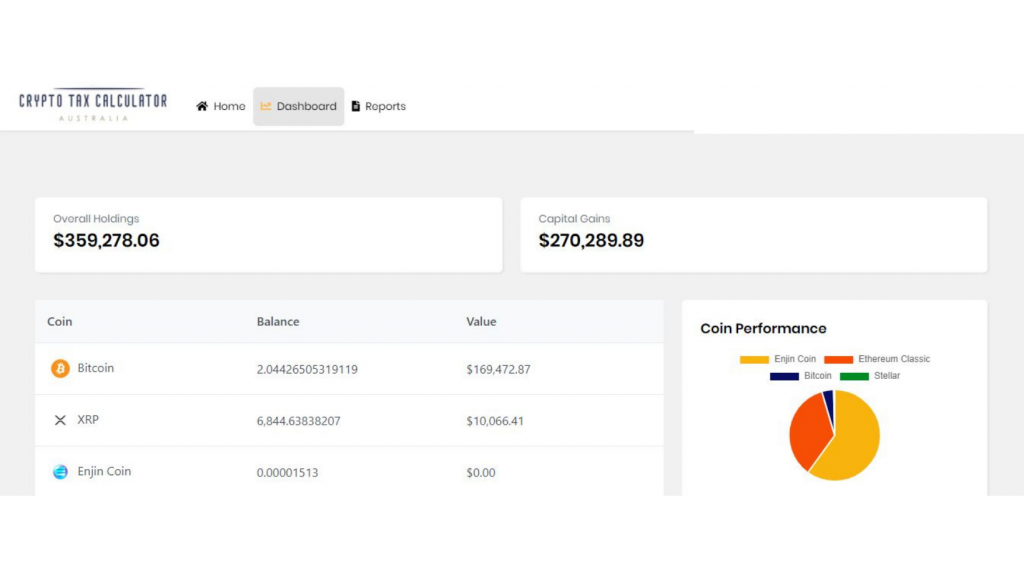

crypto tax calculator australia

Crypto Tax Calculator Australia prides itself on making it simple and easy for you the customer to use our top of the range service and application when it. This means you can get your tax details up to date yourself allowing you to save significant time and reduce the bill charged by your accountant or tax agent.

I Highly Recommend Cointracking Info For Cryptocurrency Traders To Stay On Top Of Their Gains And Do More Best Crypto Portfolio Management Best Cryptocurrency

You simply review your crypto transactions that you wish to export from your current exchange eg BTC Markets and export this data as a CSV file which is then saved to your device.

. Our Australian crypto tax calculator is the perfect tool for anyone to calculate their crypto tax. Divide the initial investment amount with the amount of crypto purchased lets assume 1000 coins. Record Keeping for Crypto Transactions.

Simply import your cryptocurrency data in form of a CSV file and calculate the capital gain taxes in Australia instantly. Capital gains from crypto assets property and shares. Disposing of cryptocurrency purchased with fiat currency a currency established by a countrys government regulation or law Tim purchased 400 USD Tether USDT for A800.

We use this to. Crypto Tax Calculator Australia Use the free crypto tax calculator below to estimate how much CGT you may need to pay on your crypto asset sale. The Australian Taxation Office ATO announced today that it will prioritize crypto capital gains alongside three other key areas of focus this year to ensure appropriate tax reporting in the country.

The ATO will be focusing on. 1 day ago1225pm May 16 2022. This will allow CryptoTaxCalculator to produce a complete tax report for any financial year personalised to meet the Australian tax requirements.

Further 2 Medicare levy tax on income of AU70000 comes to AU1400. 5 tax on income from AU45001 to AU70000 which equals to AU8125 in this case. The percentage of Capital Gains Tax youll pay is the same as your personal Income Tax rate starting only from earnings above 18201.

File your crypto taxes in Australia Learn how to calculate and file your taxes if you live in Australia. Regardless of your trading history the process does not change and is simple and easy to use so you can. Before we continue feel free to use our Australian crypto tax.

Koinly is the only cryptocurrency tax calculator that is fully compliant with ATOs crypto tax guidance. Yes you can CryptoTaxCalculatorAustralia is designed to generate easy tax reports. The Australian Tax Office ATO has outlined four key areas it will target this financial year with gains made on cryptocurrency property and.

Heres an example of how to calculate the cost basis of your cryptocurrency. Therefore our crypto tax application does not store or keep your crypto data. At Crypto Tax Calculator Australia their state of the art application makes calculating cryptocurrency tax easy whether you are a beginner trader or a crypto trading master.

Accurate and complex calculations. Australian citizens have to report their capital gains from cryptocurrencies. Here is a list of things you need before you lodge your crypto tax return with Etax.

Calculate your taxes in under 20. At Crypto Tax Calculator Australia we support and strongly believe in customer privacy. Coinpanda generates ready-to-file forms based on your trading activity in less than 20 minutes.

Ideally you should download a crypto tax report from your provider. The ATO also intends to focus on three other key areas record-keeping work-related expenses and rental property income and deductions. At Crypto Tax Calculator Australia we believe plans and pricing should be affordable no matter how much you are trading or the amount of transactions you have completed previously.

These ATO priority areas will ensure that there is an appropriate level of. The ATO noted that all crypto assets including non-fungible tokens NFTs disposed of for personal use are subject to gains since the country. In Australia youll pay Capital Gains Tax and Income Tax on your crypto investment.

Aussies are expected to keep good records of their crypto transactions whether they are using digital assets for investment personal use or in business. The Australian Taxation Office ATO has today announced four key focus areas for Tax Time 2022. You can import data for all the Cryptocurrencies you have traded with and our application will combine them all into one report.

Yes Indeed youll have to pay taxes when disposing of your crypto gains from buying selling transferring mining staking airdropping gifting or lending cryptoIn this guide well provide you with the ins outs of crypto tax regulations in Australia and strategies for minimizing your crypto taxes. Our crypto tax calculator plans can cost less per year then a subscription to a streaming service. You simply import all your transaction history and export your report.

If youre asking yourself how do I calculate crypto tax in Australia then look no further. 2019 - 2022 Crypto_Tax. If you hold for a year youll pay 50 less capital gains tax on crypto gains.

ATO Says NFTs are Taxable. Affordable plans for everyone. A record of all crypto purchases sales and interest earned.

19 tax on income between AU18201 to AU45000 which come to AU5092. Capital gains tax report. Rental property income and deductions and.

Crypto Tax Calculator for Australia. Total income tax will be AU5092AU8125 AU13217. Take the initial investment amount lets assume it is 1000.

If you sell or swap your cryptocurrency and make a profit you may need to pay tax on that profit as crypto profits are subject to capital gains tax CGT in Australia unless you are a professional trader. The resulting number is your cost basis 10000 1000 10. Koinly or Crypto Tax Calculator This report shows your profitloss and capital gains for the financial year.

Only capital gains you make from disposing of personal use assets acquired for less than 10000 are disregarded for capital gains tax purposes.

![]()

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

30 Off Crypto Tax Calculator 1 Year Subscription Rookie 29 40 Hobbyist 76 20 Investor 149 40 Trader Compare Cards Credit Card Benefits Student Rewards

Pin By Keli Joie On Quick Saves In 2022 Option Trading How To Introduce Yourself Bitcoin Value

![]()

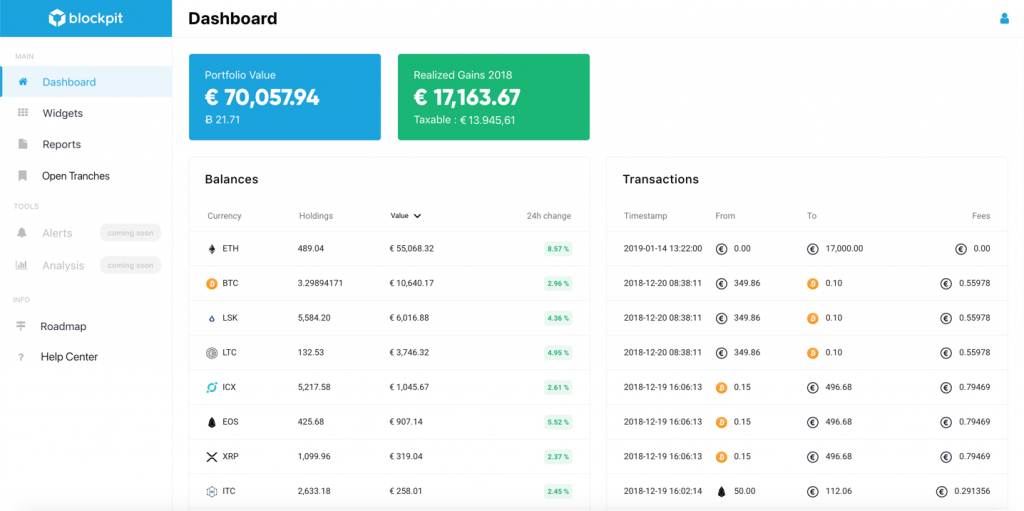

Cointracking Crypto Tax Calculator

Crypto Staking Rewards Calculator Accointing Crypto Blog Knowledge Crypto Taxes Guides Tips

![]()

Cointracking Crypto Tax Calculator

Australia Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Best Crypto Tax Software 10 Best Solutions For 2022

Bitcoin Price Prediction Today Usd Authentic For 2025

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

![]()

Cointracking Crypto Tax Calculator

![]()

Cointracking Crypto Tax Calculator

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

Crypto Tax Calculator Australia Calculate Your Crypto Tax

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

Cryptocurrency Tax Guides Help Koinly

How To Buy Cryptocurrency In Australia Buy Cryptocurrency Bitcoin Cryptocurrency